In the fast-evolving world of accountancy, continuous learning keeps us on top of changing regulations and ahead of skill gaps. To help us do this, each of the UK’s accountancy bodies has a CPD (Continuous Professional Development) scheme.

They are required to have one due to their membership in IFAC, the global organisation for the accountancy profession, and by the Financial Reporting Council. The FRC delegates its regulatory responsibilities to four Recognised Supervisory Bodies (RSBs): the ACCA, CAI, ICAEW, and ICAS, and thus has the right to lay down conditions, such as an effective CPD policy.

In our previous blogs in this series, we explored the similarities and the differences between CPD requirements worldwide. But what are the specific requirements for some of the biggest professional bodies?

To start, CPD schemes are defined either by the "inputs” – how many hours you are required to spend doing CPD, or by the "outputs” – the outcomes you have decided you need to achieve to remain relevant, up-to-date, and ready for the challenges of tomorrow. Proponents of input-based systems point to the ease of measurement and the fact that it is much harder to misrepresent whether you have done your CPD. On the other hand, proponents of output-based systems argue that they are more rigorous and that measuring compliance in hours turns the process into a cynical tick-box exercise.

CPD requirements are defined as verifiable or non-verifiable – or structured and unstructured. You can learn more about the difference between those two in our blog on verifiable vs. non-verifiable CPD. At a glance, verifiable or structured CPD must be able to be evidenced.

So, what are the different requirements?

A key requirement for all bodies is that the learning should be relevant and useful to your career. Let's explore the different CPD requirements of professional bodies around the world.

The Institute of Chartered Accountants in England and Wales (ICAEW)

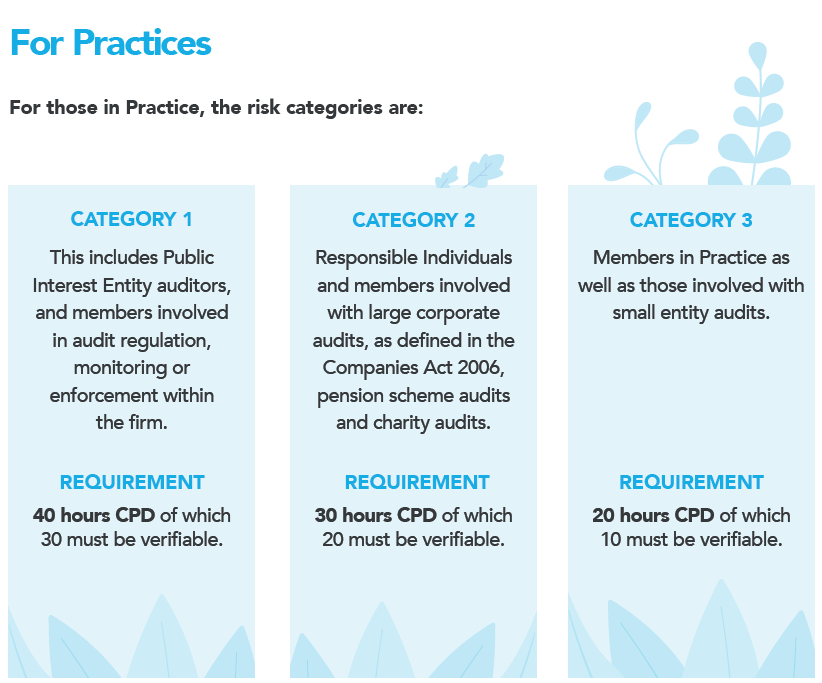

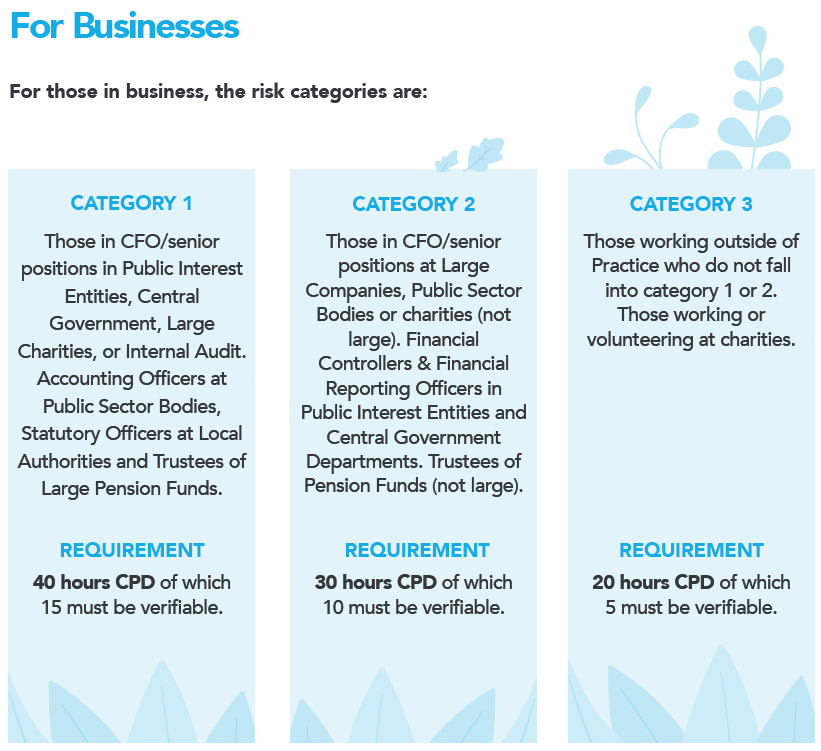

Under some pressure from the FRC, and after a consultation process with members, ICAEW has switched to an hours-based approach. All members must complete a minimum number of CPD hours every year. This includes a mandatory annual ethics CPD requirement and an overall number of CPD hours, depending on which category of risk their workplaces place them in.

ICAEW members are assigned risk categories, which determines the minimum amount of CPD you need to do in a year. The default category, category 3, has the lowest CPD requirement, though particular organisations or services can place you in a higher category. The requirements are also divided between practice and non-practice.

The ICAEW guidelines don’t just leave compliance with an individual. While practices have always needed to ensure the accountants in their team complete appropriate CPD, it has never been the primary focus of a QAD visit. That has changed.

With the switch to an hours-based system, QAD will find it much easier to assess whether a practice is taking CPD compliance seriously. So, when you receive the email from QAD, scheduling a visit, there will be one more set of records you need to produce.

If the CPD service you use doesn’t give you easy access to those records, you will have the unenviable job of asking for, and chasing down, the CPD records of every accountant in your team. If it turns out they don’t have the evidence, it may well be too late to sort the problem out.

Still unsure about ICAEW’s guidelines? You can read more about them in our whitepaper, ICAEW CPD Changes: What do they mean for you?

The ICAEW CPD year runs from 1st November to 31st October. Members need to add their CPD records to their online CPD record and firms need to keep records for their accountants.

Association of Chartered Certified Accountants (ACCA)

For ACCA members, the amount of CPD you need to do will depend on which CPD route you follow. Most members follow the unit route and need to complete 40 units of CPD annually, consisting of:

- 21 units of verifiable CPD

- 19 units of non-verifiable CPD

One unit of CPD should equal one hour of learning.

Any learning activity can count towards verifiable CPD requirements, as long as ACCA members can answer yes to these three questions:

- Was the learning activity relevant to your career?

- Can you explain how you applied the learning in the workplace?

- Can you provide evidence that you undertook the learning activity?

Approved Employer route: If you work for an ACCA Approved Employer, your employer should have an employee development programme. Take part in their appraisal process and complete your personal development plan with them to meet your CPD requirements.

New members in their first year of membership don’t need to complete CPD just yet! Members on the lifetime members register also don’t need to complete a declaration. All other ACCA members need to complete an annual CPD declaration with ACCA by 1 January of the following year.

Chartered Accountants Ireland (CAI)

CAI offers flexibility by allowing members to choose between input-based, output-based or combination approaches for their CPD requirements. What does this mean?

The input-based approach: Members must complete a specific number of structured and unstructured CPD hours each year. This includes a mix of structured CPD (verifiable) and unstructured CPD (non-verifiable).

It measures professional development based on the number of hours spent on learning. Under this model, members are required to complete 70 hours of CPD annually. Of these, at least 20 hours must be verifiable, the remaining 50 hours can be non- verifiable. If you work in practice, you will need to achieve a minimum of 10 hours of structured CPD in each service area in which you practice.

The output-based approach: Rather than tracking hours, this method focuses on the learning outcomes and the skills gained. Members are required to demonstrate, by way of outcomes, they develop and maintain professional competence.

To follow an output basis, you will be required to do the following:

- Assess what is expected of you in your current and future roles.

- Decide on and carry out your development goals, including identifying CPD activities

- Reflect on the effectiveness of your CPD activities in meeting your training and development goals step.

- Record all of the above

The combination approach: A mix of both the hours-based and output-based approaches, allowing members to sustain professional competence and fulfil their CPD requirements through a blend of structured activities and practical application of skills.

Chartered Accountants Australia and New Zealand (CA ANZ)

The CPD requirements for CA ANZ members vary depending on your designation. Here's a breakdown of the hours required:

- CA, Affiliate, or NMP: You must complete 120 hours of CPD over a three-year triennium, with at least 90 hours being verifiable CPD. Additionally, a minimum of 20 CPD hours must be completed each year.

- ACA: You are required to complete 90 hours of CPD in each triennium, with 67 hours being verifiable CPD. At least 15 hours must be completed each year.

- AT: You need to complete 60 hours of CPD per triennium, with 45 hours being verifiable CPD. A minimum of 10 hours must be completed annually.

For all members, regardless of designation, at least 6 hours of verifiable ethics-related CPD must be completed for trienniums beginning on or after 1 July 2024 (previously 2 hours per triennium).

The Institute of Chartered Accountants in Scotland (ICAS)

ICAS members need to focus on the outcomes of CPD activities, with CPD being proportionate and relevant to your role. The onus is on each member to decide what their professional development needs are and address them through a variety of CPD activities. There are no time requirements; the focus is on considering the requirements of your position and learning to address individual goals.

ICAS recommend completing CPD in four steps:

- Define current and future roles.

- Decide on training and development needs.

- Develop a personal development programme.

- Record when you have undertaken a particular CPD activity, and keep this record.

However, this doesn’t mean there are no CPD requirements. Failure to submit CPD records when requested results in a referral to the Authorisation Committee. The sanctions available to the Committee are:

- to propose a Regulatory Penalty,

- publication of non-compliance on the ICAS website and in the CA magazine,

- failure to pay a penalty and/or two consecutive years of non-compliance will be referred to the Investigation Committee as unsatisfactory professional conduct.

With accountingcpd, you and every member of your team can have easy access to CPD that ticks the boxes for all IFAC member bodies. Each person can choose from 1,500+ CPD resources to complete relevant and genuinely useful CPD, each of which come with a CPD completion certificate to use in your declaration, and securely-stored certificates and completion reports to monitor compliance.

You need to sign in or register before you can add a contribution.