Tax Investigations Tips for Accountants

This course has been reviewed and is up to date for the tax year 2017-18. This course gives you the expert guidance you need in situations where HMRC have already decided to launch an enquiry. The course will help you to find the best way of resolving the problems with the past while minimising the cost.

This course will enable you to

- Discuss with your clients the nuances in tax

- Recognise the statutory rights and obligations of both HMRC and taxpayer

- Ensure that effective and appropriate responses are provided when an approach is made by HMRC

- Select the appropriate means for disclosure to guarantee the case is handled appropriately

- Understand the penalties and provisions of a Certificate of Full Disclosure

- Identify the more practical issues with agreeing a time to pay arrangement with HMRC

About the course

This course gives you the expert guidance you need in situations where HMRC have already decided to launch an enquiry. It explores the difficult task of co-operating with HMRC while limiting the disruption, anxiety and uncertainty that an enquiry can cause. You will find useful tips to help you give the best advice in cases where your client tells you that there may be an issue with a previously submitted return. The course will help you to find the best way of resolving the problems with the past while minimising the cost.

The Tax Tips for Accountants series is a unique collection of CPD courses designed to give accountants what they need to know about tax, to help their organisation and their clients. Instead of having to wade through a mire of technical tax detail, these courses let you work through scenarios and decide what advice to give, picking up tips as you go on how to avoid the pitfalls. The series has been designed by tax specialists, Gabelle, and is based on the most frequently asked questions on their accountants' helpline.

Look inside

Contents

- Approach from HMRC

- How bad is this going to be?

- Are they sticking to the time limits?

- What can HMRC expect of you?

- What restrictions apply to HMRC?

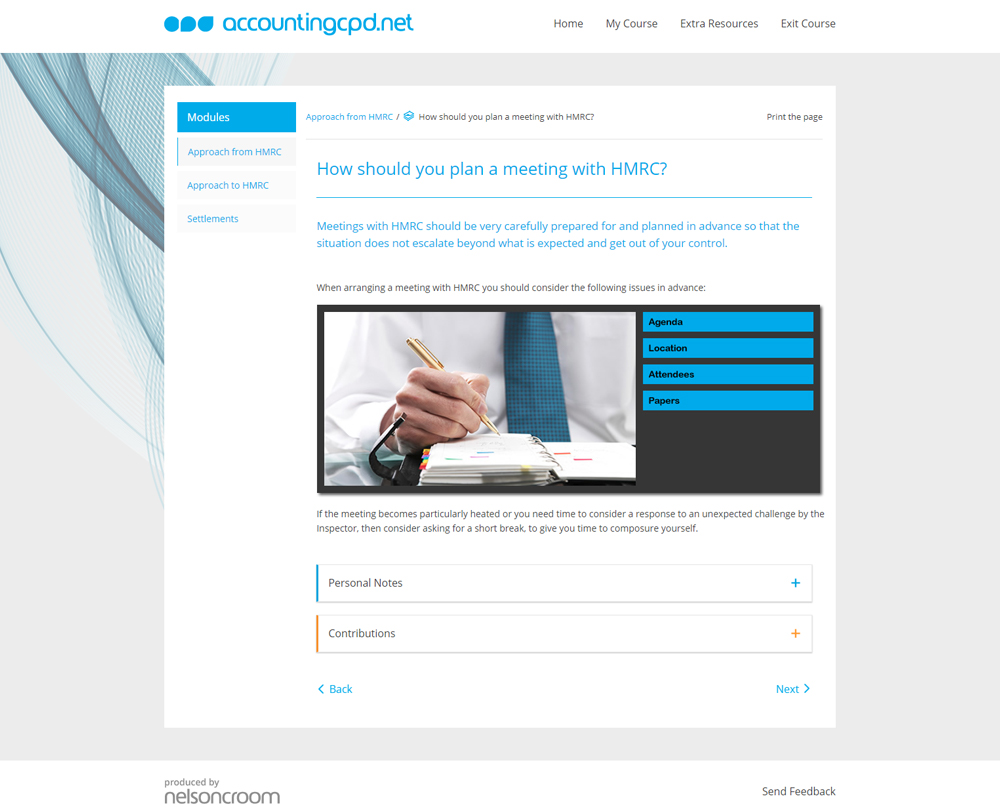

- How should you plan a meeting with HMRC?

- When can HMRC make a discovery assessment?

- Approach to HMRC

- To disclose or not to disclose?

- Formal disclosure routes

- Can your client claim relief?

- Settlements

- What is the old penalty regime?

- What is the new penalty regime?

- To disclose or not to disclose?

- How can an appeal be made?

- Can a client request time to pay?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses